- Bittensor indicators showed firm bearishness.

- A short-term price bounce was possible, but watch out for Monday’s volatility.

Bittensor [TAO] posted large losses in recent weeks as another wave of bearish sentiment swept across the crypto market. The $434 level was ceded as a support level in early 2025.

The $500 psychological level has been tested multiple times but saw swift rejections.

The most recent one happened on the 21st of February. Since then, TAO has shed 46% in value. The $216 support level from July 2024 was swiftly looming, and the bulls appeared powerless to stop more losses.

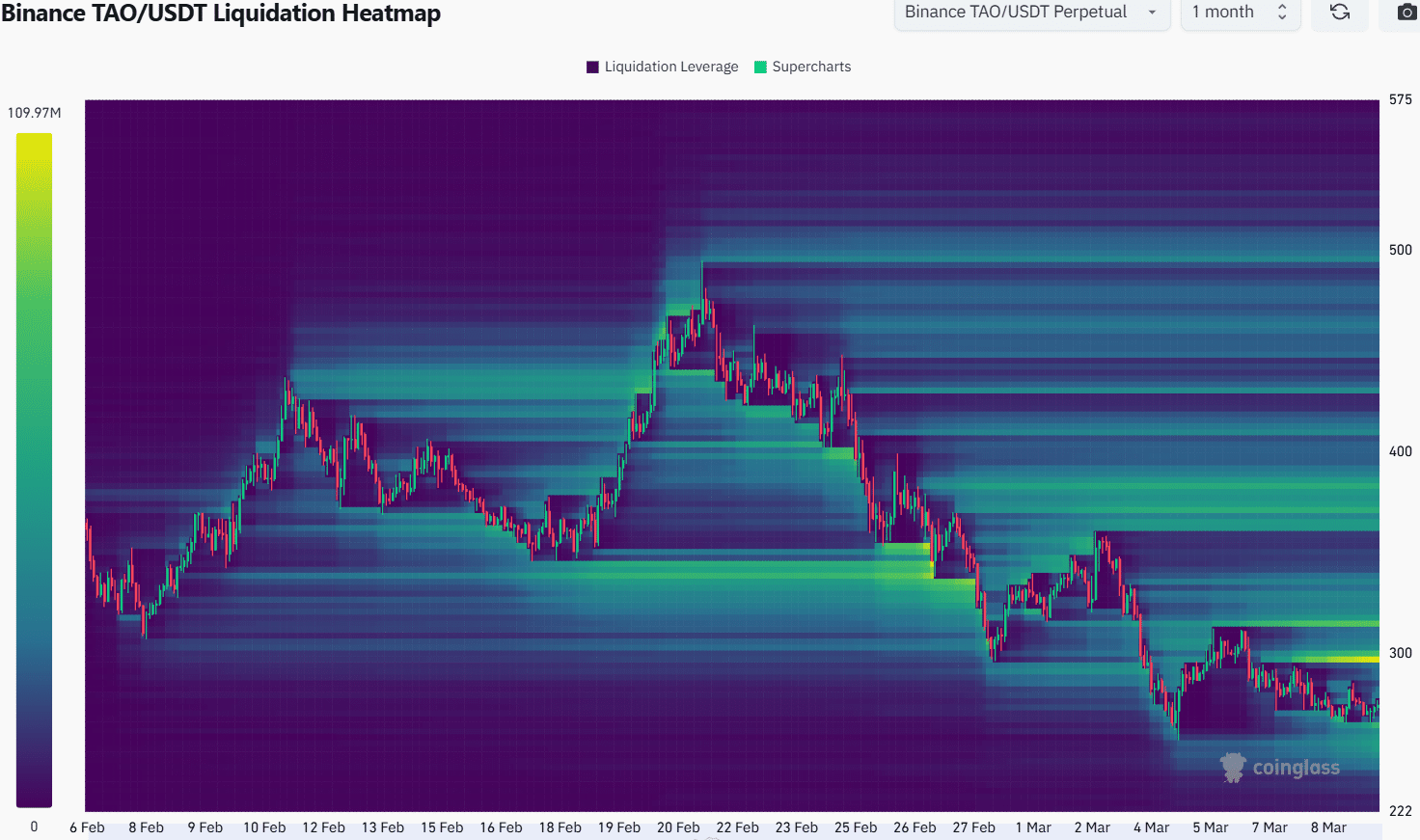

Yet, the liquidation heatmap hinted otherwise.

Is TAO readying for a 15% price bounce?

Source: TAO/USDT on TradingView

From a technical analysis viewpoint, TAO remained in a strong bearish trend. It has made only lower lows in 2025 and no new higher highs, and the daily market structure was firmly in favor of the sellers.

The Awesome Oscillator continued to show bearish dominance, as it has for most of the year. The CMF has failed to climb above +0.05 except on one occasion in the second half of February.

Even then, the volume indicator quickly retraced.

The moving averages reinforced the idea of dominant bearish momentum. The $320 and the lower high at $360.5 were the two key resistances nearby.

Source: Coinglass

The 1-month liquidation heatmap showed that the closest pockets of liquidity to the north were $296 and $314. Hence, the bulls could have a hard time driving prices further higher, in the event of a bounce.

The chance of a bounce was good, but the liquidity around $250 might need to be swept.

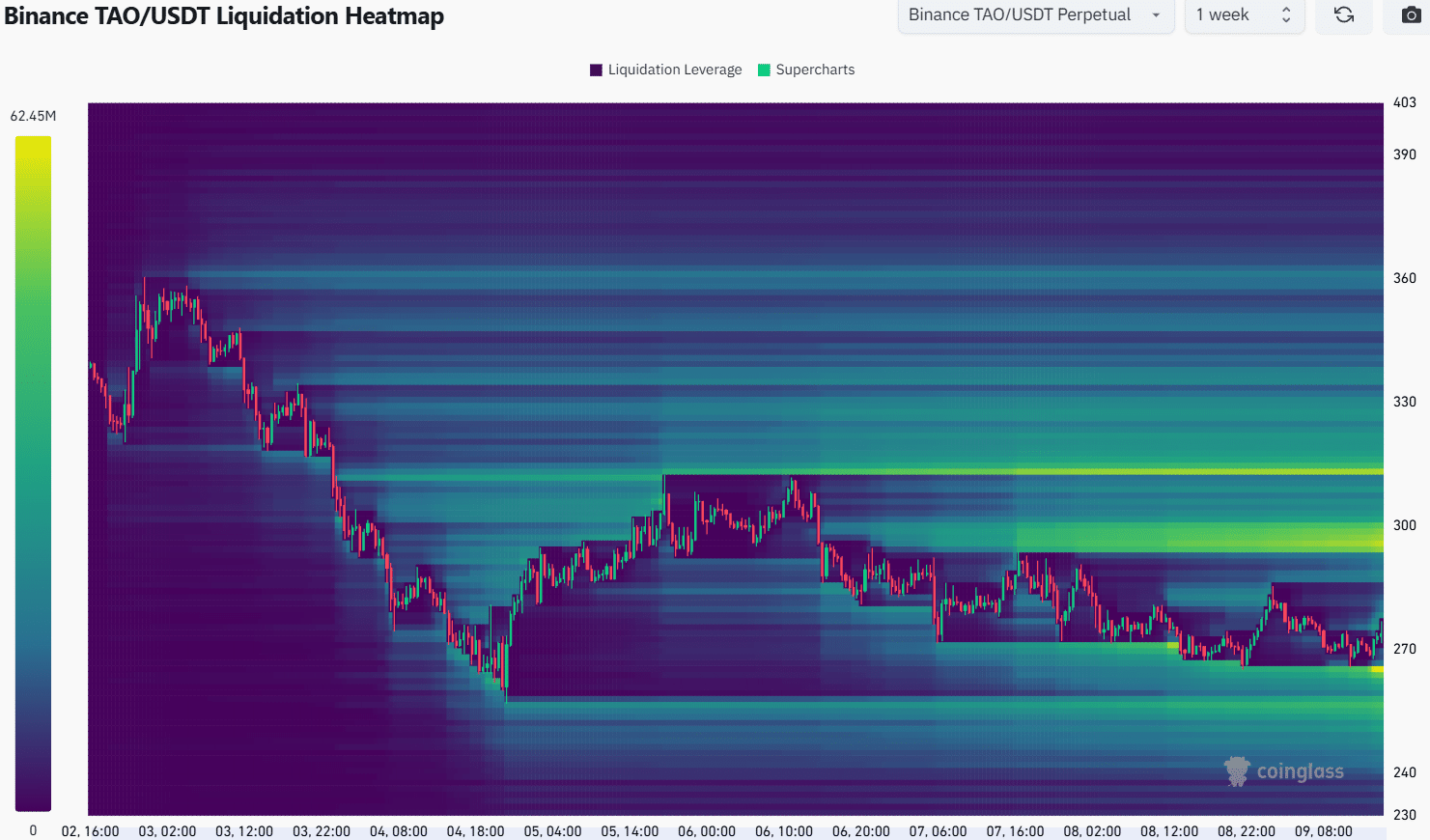

Source: Coinglass

The 1-week chart showed $250-$260 as a magnetic zone. It could be tested in the coming hours.

Depending on the Bitcoin [BTC] performance, Bittensor might fall well below $250, or it might decide to reverse the downward trajectory.

Since the liquidity around $300 was sizeable, it was likely that a price bounce was brewing. Hence, traders can look for opportunities to go long after a retest of $250-$260.

Instead of jumping in, signs of reversal on the lower timeframes can be used to gauge if it is a buying opportunity.

An uptick in volume and OI after defending this key support, or a Doji candlestick, could help traders. This was because continued BTC losses could easily take TAO prices to $216.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion