- Polygon was the sixth-largest chain in terms of total stablecoin supply.

- Whales have shown lukewarm interest towards MATIC.

The Polygon [MATIC] chain has been experiencing higher user participation and liquidity infusion in 2024, causing the broader market to sit up and take notice.

Polygon sees rise in stablecoin supply

According to AMBCrypto’s analysis of DeFiLlama’s data, Polygon’s stablecoin market cap hit nearly $1.5 billion as of this writing, marking an impressive 18% growth year-to-date (YTD). As of this writing, it was the sixth-largest chain in terms of total stablecoin supply.

Source: DeFiLlama

Stablecoins can be construed as the on-chain equivalent of cash in traditional financial markets. A higher stablecoin marketcap indicates a larger pool of liquidity, making trading on the chain easier, and thereby leading to a more efficient market.

That being said, the current levels still remained a far way off from the peak registered in July 2021. In reality, Polygon’s next aim should be the pre-bear market level of $2.6 billion achieved in September 2022.

The best-performing ETH scaling solution

The rise in stablecoin market cap comes alongside an impressive surge in user engagement on the network.

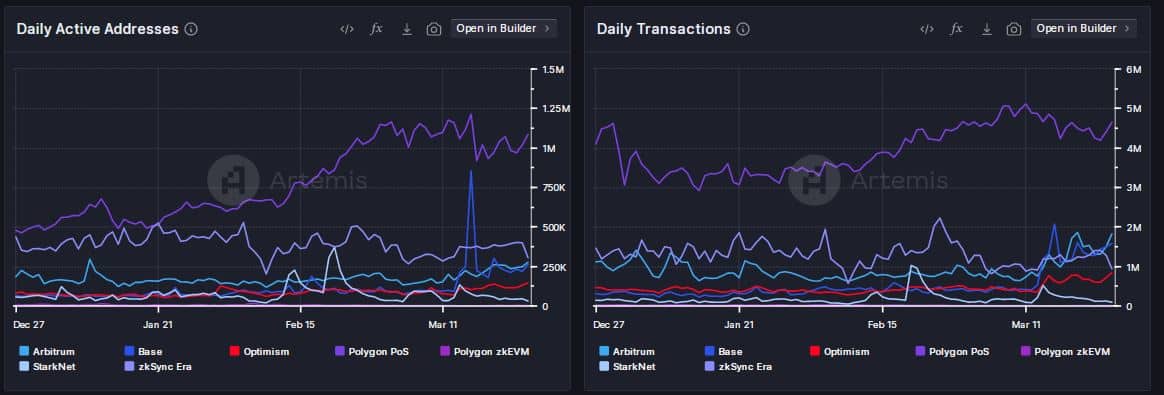

According to AMBCrypto’s examination of Artemis’ data, the Polygon proof-of-stake (PoS) chain massively outperformed other scaling networks in daily active addresses and transactions in 2024.

Source: Artemis

Take for instance, the daily active addresses count on Polygon PoS on the 26th of March was 1.1 million, more than triple the count of the second-best ranked chain on the list. A similar trend came to light when it came to transaction count.

Will whales show interest?

The chain’s native token MATIC rose 1.73% in the last 24 hours, taking its last seven-day gains to over 11%, as per CoinMarketCap. MATIC’s performance was in line with the broader altcoin market report card. On a YTD basis, the crypto was up 12%

Is your portfolio green? Check out the MATIC Profit Calculator

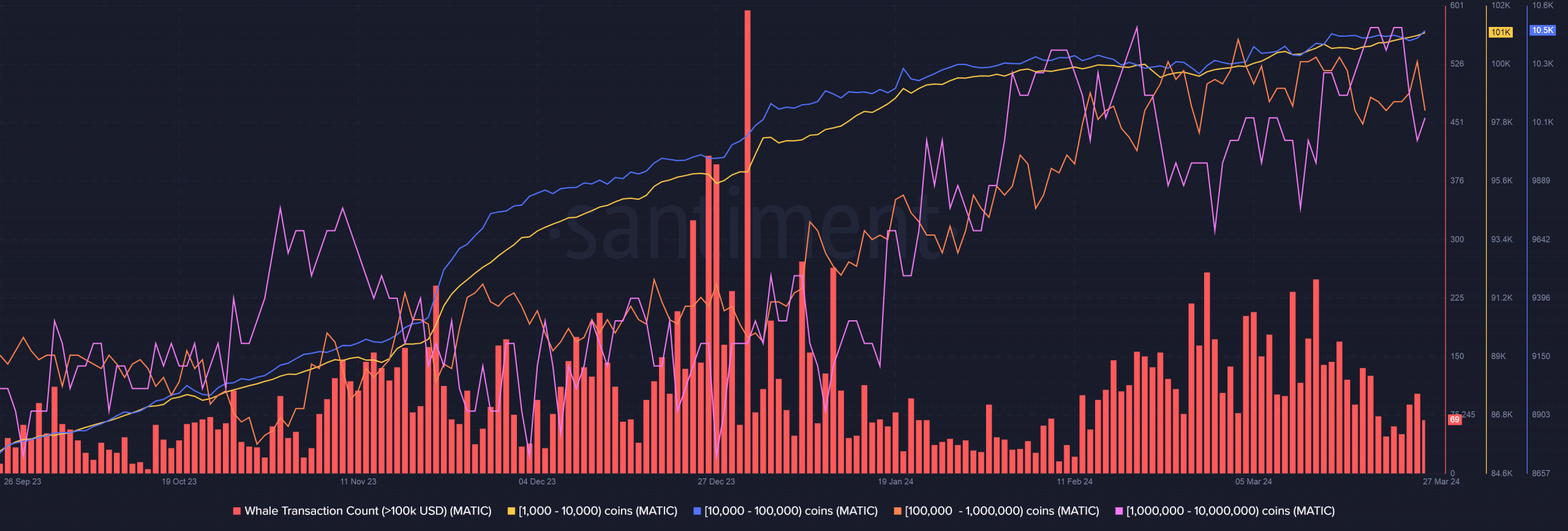

Interestingly, the rise was not built on whales’ accumulation. Using Santiment, AMBCrypto noted a sharp drop in whale transactions in 2o24.

Moreover, the holdings of these influential investors remained flat during this time, implying lower engagement from whales.

Source: Santiment