Key Takeaways

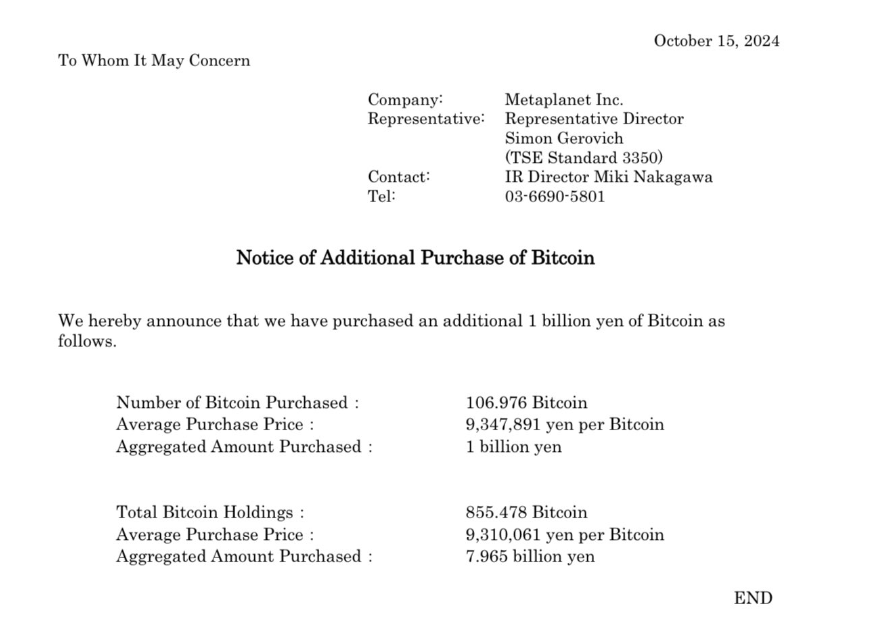

- Metaplanet’s recent purchase of 106 BTC boosts its total holdings to over 855 BTC.

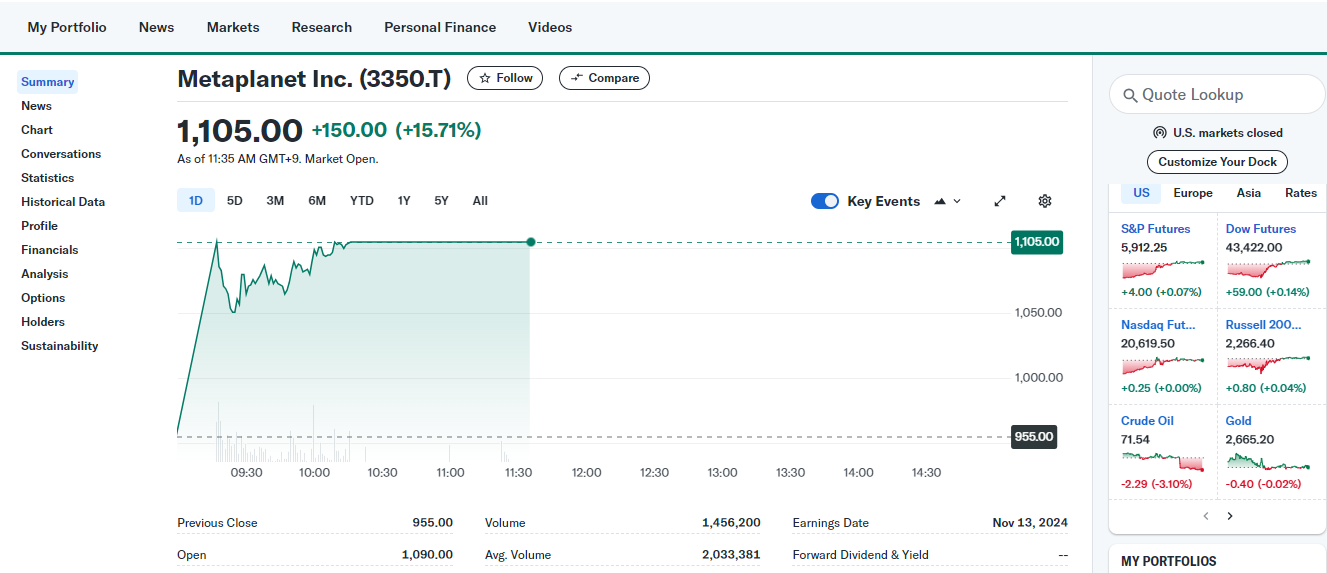

- The company’s stock surged 15% following the announcement of the Bitcoin acquisition.

Share this article

Metaplanet’s stock (3350.T) surged over 15% on October 15 (Asian time) after the company announced it added over 106 Bitcoin to its reserves. According to data from Yahoo Finance, the stock price reached 1,105 JPY, a substantial jump from the previous close of 955 JPY.

The latest acquisition brings Metaplanet’s total Bitcoin holdings to over 855 BTC, valued at around $56 million at current prices. The company’s average purchase price per Bitcoin stands at about $62,200, which is below the present market price of $65,700.

The company has made four Bitcoin purchases this month. The third acquisition was just made on October 10, following earlier ones on October 1 and 7.

Metaplanet CEO Simon Gerovich said the goal was to accumulate at least 1,000 BTC. With the new acquisition, the company is now only 145 BTC shy of its target. It appears that Metaplanet has no plans to sell its holdings soon.

The company’s accumulation positions it as the 17th largest public company holder of Bitcoin, according to data from Bitcoin Treasuries. Continuing at this pace, Metaplanet is poised to surpass Hong Kong-based Meitu, which holds 940 BTC, becoming the largest holder of Bitcoin among Asian public companies.

Share this article