- Hyperliquid’s HLP Vault suffered a $4 million loss after absorbing a liquidated high-leverage Ethereum position.

- Eight large wallets withdrew $14.35 million USDC from Hyperliquid following the liquidation event.

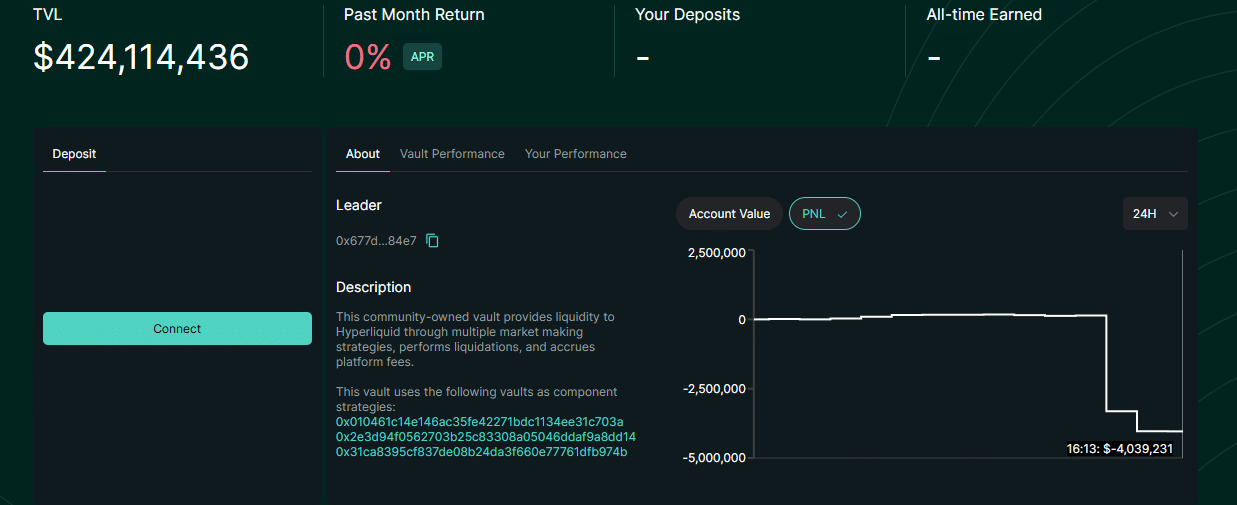

Hyperliquid’s [HYPE] HLP Vault, designed to absorb liquidated positions, has recorded over $4 million in losses following the forced liquidation of a highly leveraged Ethereum [ETH] long position.

A whale trader identified as ‘0xf3f4’ engaged in high-stakes leveraged trading on Hyperliquid, a decentralized perpetual exchange.

The trader initially deposited $15.23 million USDC and built a massive 175,000 ETH long position, valued at approximately $340 million.

Source: Arkham

The position had an average entry price of $1,884.4 per ETH and a liquidation price of $1,839, leaving it highly vulnerable to price fluctuations.

At its peak, the whale achieved an unrealized profit exceeding $8 million. Seizing this opportunity, the whale partially exited the position by selling 15,000 ETH and transferring $17.09 million USDC to their wallet.

Source: Hyperliquid

One move too many—the domino effect begins

This action had notable repercussions. By reducing the account’s margin, the liquidation price for the remaining 160,000 ETH long position rose, leaving it more vulnerable to market volatility.

As Ethereum’s price declined, the position breached its liquidation threshold. Hyperliquid’s automated system transferred the liquidated assets to its HLP Vault, an on-chain liquidity pool created to manage and unwind failed trades.

The vault takes the hit

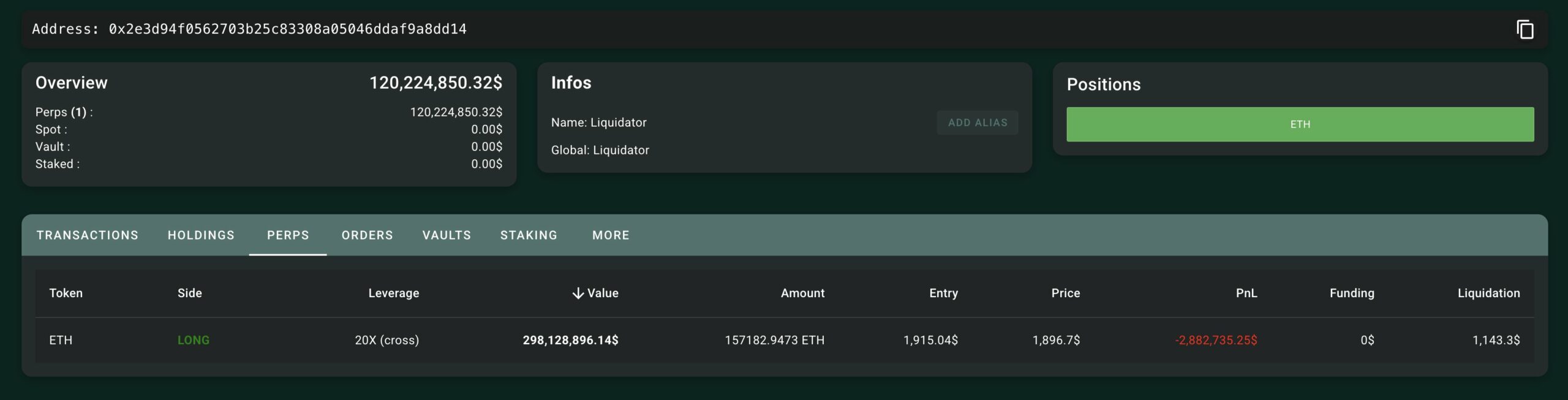

The vault took over the ETH position at $1,915 per ETH and began gradually selling it off.

However, as the market price of ETH dropped below $1,896.7, the vault started accumulating significant floating losses.

By the time Hyperliquid addressed the incident publicly, the HLP Vault had lost over $4 million within 24 hours, with losses still increasing as the vault continued unwinding the large ETH position.

Source: Hyperliquid

Blockchain analysis by Lookonchain shed light on the whale’s trading patterns and subsequent market reactions.

High-value transactions revealed rapid fund flows between Hyperliquid and external liquidity pools. The wallet’s portfolio was heavily weighted toward Ethereum-based assets (AETH/ETH) and gold-backed tokens (PAXG), suggesting a strategy involving leveraged ETH positions hedged with gold.

Meanwhile, market depth analysis by EmberCN indicated challenges in Hyperliquid’s liquidation system, which struggled to process the whale’s position without disrupting ETH’s price trajectory. This caused additional selling pressure, worsening the vault’s losses.

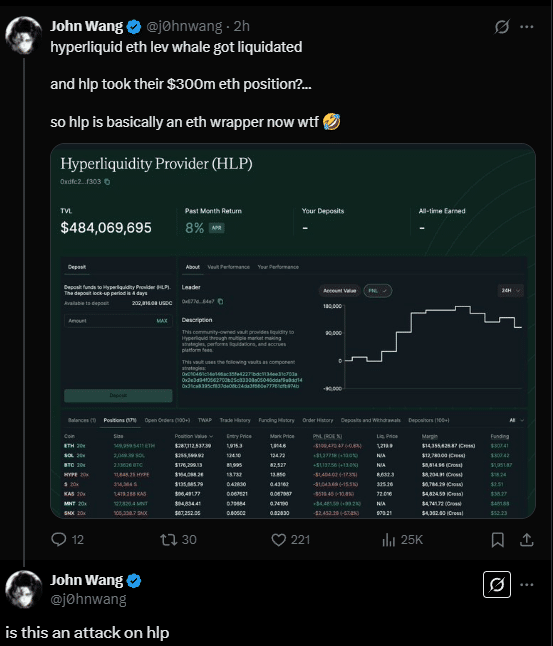

The large-scale liquidation and its impact on Hyperliquid’s liquidity system ignited widespread industry debate.

Source: X

Analysts questioned whether this was simply a high-risk trade gone wrong or a deliberate attempt to exploit Hyperliquid’s liquidation mechanics.

Hyperliquid’s HLP Vault operates as a community-backed risk management fund, absorbing liquidated positions from the platform’s automated liquidation system.

This model, while effective in most cases, can become vulnerable when individual traders build oversized, high-leverage positions that the vault may struggle to absorb efficiently.

Was the liquidation intentional?

On-chain analysts believe that the whale intentionally triggered liquidation to shift risk onto the HLP Vault, avoiding direct losses.

By withdrawing a significant margin before liquidation, the trader raised their liquidation price, ensuring closure at a higher price. This forced Hyperliquid’s engine to buy liquidated assets at inflated prices, leaving the HLP Vault with costly positions.

If the whale held short positions elsewhere, they likely profited from market-wide selling caused by their own liquidation. This tactic, called liquidation arbitrage, has been seen in DeFi cases where traders exploit systems for profit.

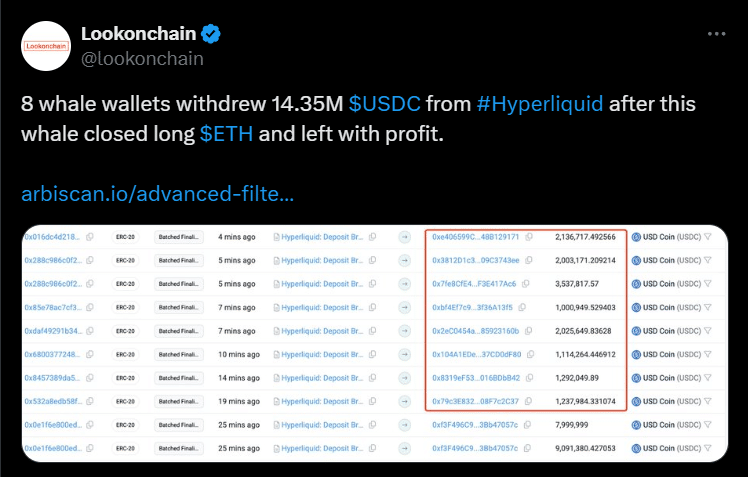

After the whale’s liquidation, Lookonchain reported eight wallets withdrawing $14.35 million USDC from Hyperliquid.

Source: X

Hyperliquid responds

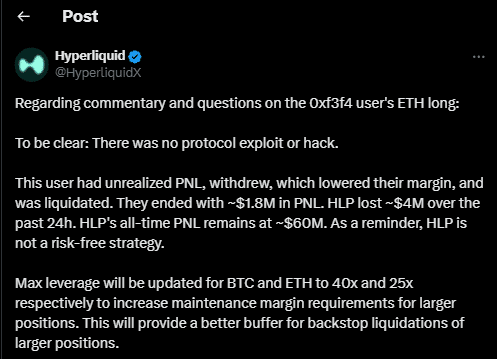

In an official statement posted on X (formerly Twitter), Hyperliquid denied any security breach or exploit, instead framing the event as a consequence of high-leverage trading and margin mismanagement.

Source: X

The company emphasized that the whale had withdrawn its margin, increasing their liquidation risk, and that the HLP Vault was simply fulfilling its role in absorbing the position.

Hyperliquid also announced immediate changes to leverage limits, aiming to prevent similar events in the future.

The exchange reduced the maximum leverage for Bitcoin [BTC] trades to 40x and cut Ethereum leverage to 25x. They implemented these adjustments to increase margin requirements for large positions, providing greater protection against systemic liquidations.

Is this the end of high-stakes liquidation manipulation?

The Hyperliquid liquidation event has sparked a significant debate within the crypto community. Was this simply high-risk trading gone wrong, or a calculated effort to exploit the system?

This isn’t the first time Hyperliquid has faced concerns about potential market manipulation. Just weeks before the liquidation event, a whale trader executed a highly profitable 50x leveraged trade on Bitcoin and Ethereum.

This coincided with U.S. President Donald Trump’s announcement about crypto’s inclusion in the U.S. Crypto Strategic Reserve.

The trader earned $6.8 million within 24 hours, raising suspicions of insider trading. The parallels between the Trump announcement trade and the recent liquidation event suggest Hyperliquid may be attracting whales who strategically time-leveraged positions for maximum gains.

Whether these trades are coincidental or indicative of deeper manipulation remains uncertain. While Hyperliquid’s liquidation model has generally been effective, oversized, high-leverage positions expose the platform to liquidity shocks.

As Hyperliquid tightens its leverage policies, the question lingers—will these measures be enough to prevent future liquidation arbitrage?